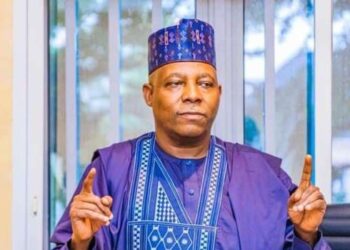

Special Adviser to President Bola Tinubu on Economic Matters, Tope Fasua, has defended Nigeria’s borrowing practices, arguing that the country is actually under-borrowing despite growing concerns about rising national debt levels.

Speaking during a Channels Television interview on Tuesday, Fasua countered widespread fears about Nigeria’s debt trajectory, maintaining that national debts have actually decreased since the current administration took office. He emphasized that with a debt-to-GDP ratio of 39 percent, Nigeria’s borrowing remains within manageable limits compared to international standards.

Fasua provided historical context to support his argument, noting that debt servicing challenges have significantly improved under the current administration. He revealed that recent data shows debt servicing costs are 64 percent lower than previous levels, contrasting this with the critical situation in 2022 when Nigeria’s debt servicing consumed up to 120 percent of government revenues, forcing the country to borrow an additional 20 percent just to meet existing debt obligations.

The presidential adviser assured Nigerians that the government’s borrowing strategy focuses exclusively on developmental projects rather than wasteful expenditure or embezzlement. He drew parallels between national debt management and corporate financial strategies, arguing that thriving companies routinely manage debt portfolios by paying down existing obligations while taking on new loans to fund growth and expansion.

Fasua highlighted improvements in state-level debt management, revealing that state governments have successfully reduced their debt burdens by 42 percent between 2023 and 2024. This achievement, he argued, demonstrates the effectiveness of current fiscal policies and the improved capacity of subnational governments to manage their financial obligations.

Despite his confident assessment, Fasua acknowledged that constructive criticism of government borrowing policies remains welcome. He specifically invited scrutiny regarding borrowing priorities, interest rates, lender selection, debt management practices, and mechanisms to ensure borrowed funds reach their intended developmental purposes. He also expressed openness to discussions about identifying cash flow-generating projects that could help service debts even when immediate repayment funds are unavailable.

However, recent official data presents a more complex picture of Nigeria’s debt situation. According to information from the Debt Management Office and the National Bureau of Statistics, Nigeria’s external debt reached approximately $45.97 billion, equivalent to N70.63 trillion, by the first quarter of 2025. This figure represents a substantial 26.07 percent year-on-year increase from the corresponding period in 2024, driven by new government borrowings and the continued depreciation of the naira against major international currencies.

Fasua justified this increased borrowing by pointing to Nigeria’s massive infrastructure deficit, which he estimated requires approximately $3 trillion or more annually to address adequately. He emphasized that the country faces urgent needs for road construction, infrastructure maintenance, and various developmental projects across all regions.

The presidential adviser argued that infrastructure development serves as a critical tool for poverty reduction, specifically targeting what economists term multidimensional poverty. This concept encompasses non-income forms of poverty related to inadequate access to basic infrastructure and services. Fasua contended that infrastructure investment represents the most effective strategy for addressing these broader poverty indicators.

Supporting his poverty reduction claims, Fasua suggested that the current administration’s infrastructure focus has already yielded significant results, claiming that approximately 120 million Nigerians have been lifted out of multidimensional poverty through improved infrastructure access.

The debate over Nigeria’s debt levels occurs against the backdrop of broader economic challenges facing the country, including inflation, currency depreciation, and concerns about fiscal sustainability. While Fasua’s assessment presents an optimistic view of debt management under the current administration, critics continue to express concerns about the long-term implications of rising debt levels for Nigeria’s economic stability and future generations.